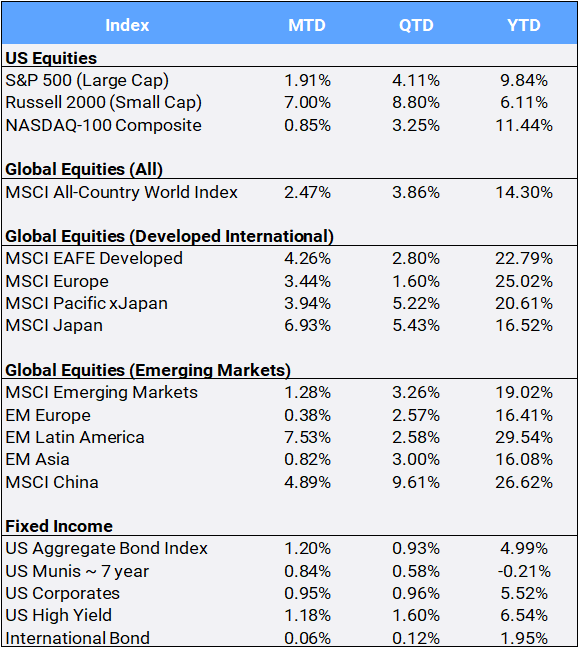

Global stocks continued their record-setting run, rallying 2.47% in August, notching their fifth winning month in a row. The MSCI All Country World Index’s (ACWI) touched a new all-time high on August 28th and is up 14.30% so far in 2025. There was a notable rotation into global small cap and value stocks, as the MSCI ACWI Small Cap and Value indices outperformed in August gaining 4.80% and 3.24%, respectively. In the US, small cap stocks shot up 7.00% this month relative to the 1.91% large cap S&P 500 index, as smaller companies with higher debt loads may benefit from a looser US Federal Reserve policy that was indicated following the Jackson Hole symposium in which Chairman Jerome Powell signaled that the central bank is likely ready to cut rates as early as next month.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of August 31, 2025

After trading near flat for the prior three months, gold prices woke up and surged 4.80% in August to bring YTD returns to 31.38% as US inflation data reinforced expectations that the Fed will cut rates in its next meeting. Fixed income traders are pricing in an 87.60% probability of a 25 bp rate cut when it meets September 16-17 (up from 37.66% last month). Non-yielding gold typically performs well in a low-interest-rate environment. It closed the month at an all-time high of $3,447.95/ounce, the same day that a US Federal Appeals court ruled that President Trump’s “reciprocal” tariffs are illegal – increasing uncertainty further for global trade.

Investors are also keeping an eye on the escalating feud between the White House and the Federal Reserve, which is fueling concerns about the central bank’s independence. A hearing on Fed Governor Lisa Cook’s request to block Trump from firing her ended without a ruling, indicating her fate is still uncertain. It is speculated that Cook’s removal would give Trump the opportunity to create a board of governors at the Fed who are more open to lower interest rates, which the president has long been clamoring for.

The US dollar remained under pressure, depreciating 2.20% against a basket of international currencies. It is off 9.88% YTD. Geopolitical uncertainty has also crept its way into the bond market as the yield curve steepened. While the 2- and 10-year treasury yields declined 8.60% and 3.33% respectively to end the month at 3.62% and 4.23%, the 30-year crept higher to 4.93%.

A depreciating dollar means foreign currencies are appreciating, giving an extra boost to international stocks for US investors. In local currency terms, the MSCI ACWI ex US World Index (which excludes US stocks and includes both emerging and developed international markets) gained 2.09% MTD and 13.30% YTD, however, when adjusting for the FX appreciation, those indexes are up 3.47% and 21.64%, respectively, when translated into US dollar returns. On the economic front, the second estimate of US Q2 GDP was revised higher to +3.3% from +3.0%, while the Atlanta Fed’s Q3 GDP forecast jumped from 2.2% to 3.3% with the upgrade arriving despite the US trade deficit widening significantly in July (often a drag on economic growth) as businesses ramped up imports ahead of the early August tariff deadlines. In developed markets, Japan was the best MTD performer up 6.93%, and Spain leads YTD returns with a whopping 51.88% gain. In Emerging Markets, those categories are both represented by Colombia, up 11.98% MTD and 58.11% YTD.

Nine of the eleven US sectors finished the month positively led by healthcare (5.38%) and materials (5.17%). The only detractors were interest-rate sensitive utilities (-1.58%) and technology (-0.02%). The AI trade started to show cracks this month as Nvidia weighed sector after issuing a tepid sales forecast due to looming export uncertainty, and Marvell Technology plunged after the artificial intelligence chip maker reported that it expects weaker data center revenue. In addition, the Wall Street Journal reported that Chinese e-commerce giant Alibaba has created a more advanced chip as it looks to fill the gap left by US chip companies running into issues around exporting their chips to China. The CSI China Internet index surged 7.73% MTD and is up 30.57% YTD.

Bitcoin, the world’s largest cryptocurrency, traded as high as $122,951.91 on August 13th, but cooled to end the month down 7.46%. Still, the asset referred to as “digital gold” remains up 15.03% YTD.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of August 31, 2025.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.