Your First Pro Athlete Paycheck: Where the Money Really Goes

Understanding your income is the first play in long-term financial success

Congratulations on achieving your lifelong dream of becoming a professional athlete.

After years of training, early mornings, and late nights, you’ve earned your spot as a professional athlete. But as the excitement builds, so does the responsibility to manage your first paycheck.

While you’re ready for the competition on the field, few rookies are fully prepared for what happens once their direct deposit hits. Our Athlete Wealth Management team helps players make sense of that first paycheck and plan for what comes next.

The rookie reality of short careers and big numbers

Each sport is different, but the pattern is similar: a sudden surge of income over a short career window.

Take the NFL as an example. In 2025, 257 players were drafted across 32 teams, with the minimum rookie salary set at $840,000. The average career lasts only 3.3 years, meaning a typical player might earn around $3 million before hanging up their cleats.

For first-round picks, that can look like long-term financial security. But for most players, these earnings must support decades of life after sports. Understanding where your money goes is the first step in making it last.

What’s in a pro athlete paycheck?

Your game check is more than your “salary.” It’s a combination of income sources and deductions that can surprise even seasoned players.

Common income sources

Common Deductions

Understanding your paycheck

Not every athlete’s first paycheck looks like a headline number.

Early in your career, you might see smaller amounts from mini-camp or pre-season activities before the regular-season checks begin. These early payments are still taxed and subject to deductions.

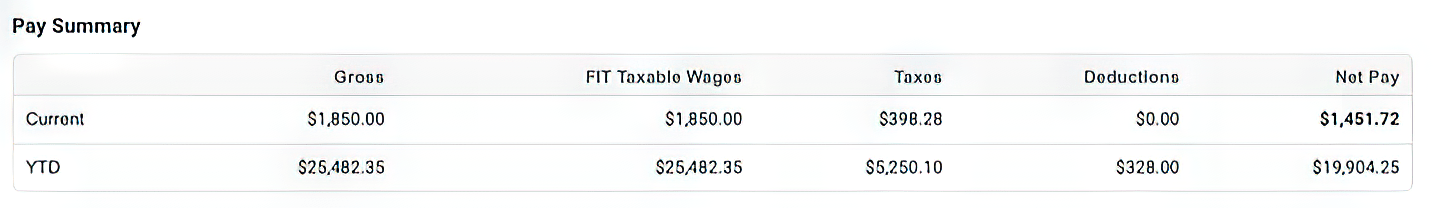

Here’s a real example of a player’s first check

Click to enlarge

This player’s early check shows a gross pay of $1,850, with about $400 withheld for taxes, leaving roughly $1,450 in take-home pay.

Even though the amount feels small, it’s a useful exercise in understanding where every dollar goes. These same deductions scale up once the real paychecks start rolling in.

Now let’s look at what a typical “game check” might actually look like during the regular season.

Sample game check (based on an $840,000 salary)

What this means:

- An athlete keeps about $12,000 (53%) in take-home pay from a single game check.

- The remaining $11,000 (47%) goes toward taxes, fees, and deductions before any personal spending begins.

It’s a powerful reminder of why smart financial planning starts on day one.

The hidden challenge of earning fast and spending faster

According to a National Bureau of Economic Research study, 78% of professional football players experience financial distress within three years of retirement. ESPN also found that one in seven former players file for bankruptcy within 12 years of leaving the league.

Why does this happen?

Because without a plan, the combination of high income, short career span, and lifestyle pressure can drain even multi-million-dollar contracts.

From rookie days to retirement with the right financial advisor

Even after taxes and deductions, your paycheck likely exceeds what most people earn in a year. A trusted Perigon advisor can help you turn that short-term income into long-term stability by focusing on:

Cash flow and savings discipline

Budgeting for irregular income and setting up reserves for off-seasons or injuries.

Tax-efficient investing

Managing multistate taxes and using the right retirement accounts to keep more of what you earn.

Diversification and wealth preservation

Balancing opportunity with protection by spreading investments and avoiding unnecessary risk.

Career transition planning

Preparing for what’s next after sports, like coaching, business, or retirement.

Why athletes choose Perigon Wealth

We are a national independent RIA serving clients across the United States with a personalized, planning-first approach.

Our Sports division specializes in the unique needs of athletes, from multistate tax planning to post-career transitions.

Through our partnership with Premier Sports Network (PSN), Perigon provides educational resources and wealth management strategies to more than 30,000 sports professionals across North America.

We help athletes turn short earning windows into lifelong financial strength with clarity, structure, and trust.

Let’s talk about your financial game plan

Your paycheck reflects years of dedication. Let’s make sure it sets up your future, not just your season.

Contact the Sports Advisory Team

Frequently Asked Questions

How much do professional athletes pay in taxes?

Many athletes see 40–50% of their earnings go toward taxes. That total can include income taxes, payroll taxes (Social Security and Medicare), and something known as the “jock tax.”

Players earn income in every state (and sometimes country) where they compete. They often owe taxes in multiple jurisdictions. For example, an athlete who plays for an Arizona team but travels to California or New York for games will typically file tax returns in those states too. How much is owed depends on income, where they play, and how the contract is structured.

Can rookie athletes negotiate how they get paid?

A rookie contract has limited flexibility. If a player is fortunate enough to make it to a second contract, there is much more negotiation.

Why do athletes need specialized financial advisors?

Specialized advisors who understand the industry help simplify decisions and safeguard wealth. Athletes face unique challenges, like:

- Creating consistent cash flow even when paychecks stop

- Managing multi-state taxes and filings

- Building a diversified portfolio designed to outlast playing years

- Planning ahead for what comes next, such as business ventures, coaching, or retirement

The right advisor helps turn a brief earning window into a foundation for lifelong financial strength.

How are signing bonuses and endorsements taxed?

A signing bonus is usually taxed at the federal supplemental rate and may also be subject to state taxes in the place where it’s earned, even if you receive it before the season starts. Endorsement income is taxed as self-employment income, which means additional payroll and business-related taxes apply. They are both taxable income, but they’re treated a little differently.

What happens to my pay during the off-season?

Under the most recent Collective Bargaining Agreement (CBA), many players now receive their salaries in 36 weekly installments instead of being paid only during the regular season. Athletes will continue receiving income through the off-season, making it easier to budget, manage expenses, and plan for the year ahead.

Sources

- Spotrac NFL Rookie Scale. (2025).

https://www.spotrac.com/nfl/cba/rookie-scale/_/year/2025 - Keim, John. (2016). With average NFL career 3.3 years, players motivated to complete MBA program.

https://www.espn.com/blog/nflnation/post/_/id/207780/current-and-former-nfl-players-in-the-drivers-seat-after-completing-mba-program - Carlson, Kyle, et al. (2015). Bankruptcy Rates among NFL Players with Short-Lived Income.

https://www.nber.org/system/files/working_papers/w21085/w21085.pdf