2023 was a great example of the futility of such big picture forecasting. At the beginning of the year the consensus view of strategists was that the US economy would enter a recession at some point in 2023 and the median forecast return for the S&P 500 was +6%1. Fast forward one year, and the US economy is on track to have grown by over 2%2 in 2023 and the S&P 500 is up +24%3.

2023: A Year in Review

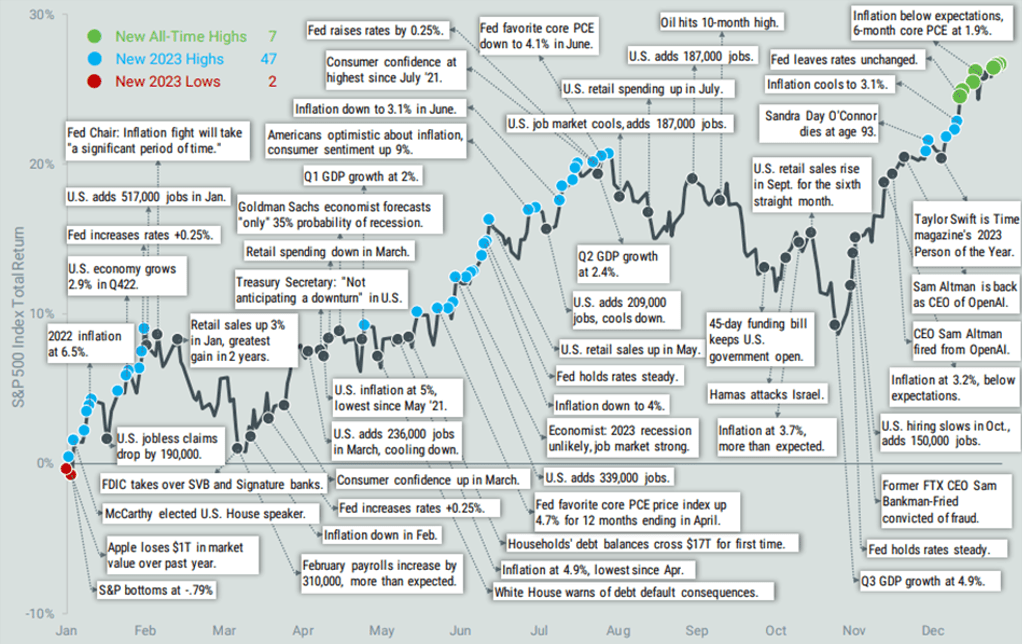

A lot can happen and change in the market over the course of 365 days, as shown in the chart below. We started out the year with high inflation, a strong labor market, and the Fed poised to continue raising rates. In March, the Fed’s swift actions in raising rates appeared to have finally broken something as Silicon Valley Bank and Signature Bank collapsed. In that moment, there was fear of broader banking turmoil and concerns about the fallout to the venture capital industry, which banked at both of those banks. The crisis was contained, and the market rose in the second quarter buoyed by optimism about the promise of artificial intelligence. The latter half of the year was marked with concerns of a US government shutdown and the deadly Hamas attack in Israel potentially causing a broader regional conflict. Those fears too were averted, and the S&P 500 finished the final two months of the year with a sharp Santa Claus rally.

1 Source: Avantis Investors

The Complex Nature of Economic and Market Predictions

The economy and financial markets are, by their very nature, difficult to predict. The actions of millions of individuals determine what happens in the economy. While there are governments and institutions like the Federal Reserve that set fiscal and monetary policy and whose actions have broader impact, even their actions aren’t easy to predict and are reactive to the environment and data as it comes in.

The stock market, though related to the economy, is comprised of a subset of companies that make up the broader economy and so what happens in the economy doesn’t necessarily translate to stock market performance. Additionally, the future expectations and the risk appetite of investors impact the prices of stocks and the value of the overall market.

The bottom line: forecasting is hard. So, take all of those beginning of year strategist round-ups and predictions with a grain of salt. Treat them like bubble gum for your mind, something to consider but be wary of making large portfolio changes based on them.

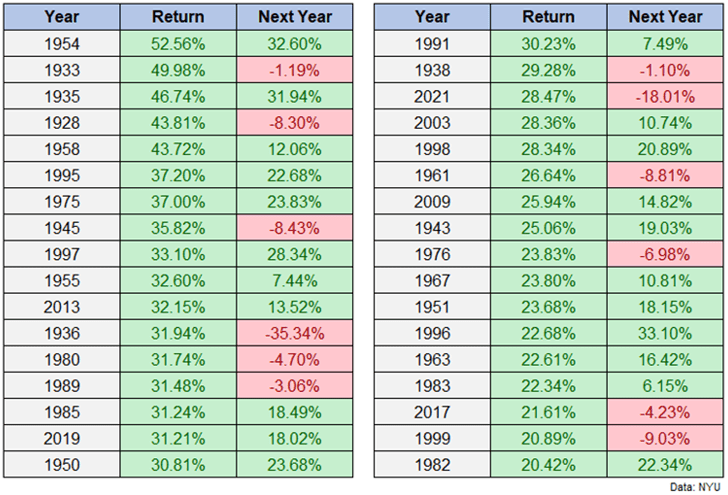

Historical Insights: Post-20% Gain Years

There are probably strategists out there today warning that the market is overvalued and the chances of 2024 being another positive year are slim. No predictions here, but just looking at the historical returns of the US market after a 20% gain year tells us a few things. On average the return following a 20% up year was a positive 8.9% and the stock market was up 65% of the time (22 out of the 34 years) following a 20% gain4. It may seem overly simplistic to look at these numbers in isolation without any other context, but context changes so quickly in the short term (as noted above) that zooming out can provide perspective.

4 Source: Ben Carlson, A Wealth of Common Sense

New year, new you…vow to stop fretting over macro forecasts

Instead of expending energy on strategists’ forecasts, it is more valuable to pay attention to and understand the risk and return tradeoffs between different segments of the financial markets and asset classes over time. Additionally changes to your own financial situation and risk appetite are important to consider in how you allocate your portfolio. 2024 is an election year and history shows that these years tend to be more volatile for the market.

If you have any questions about your own financial situation or want to review your portfolio reach out to one of our advisors to schedule a time to discuss.

2 Source: Conference Board

3 Source: Morningstar