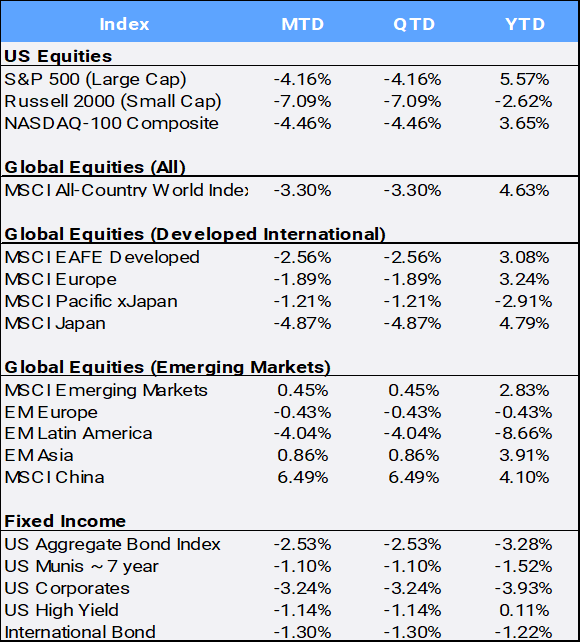

Global stocks broke a five-month winning streak by falling 3.30% in April, but the MSCI All Country World Index remains up 4.63% YTD. Despite the April setback, the MSCI ACWI is still up almost 20% from its low last October. April was also ugly for the U.S. major indexes: the Dow dropped 5% in its worst monthly performance since September 2022. The S&P 500 slid 4.16%, while the small cap Russell 2000 fell 7.09%, which dragged its YTD into the red, down -2.62%. Ten of the 11 S&P sectors fell in April; only Utilities had a positive return, up 1.65%. The Real Estate sector was the worst performing sector this month, down -8.50% for April and 9.0% YTD. The CBOE S&P Volatility Index (VIX), often referred to as “the fear index,” spiked to 15.65, up 20.29% MTD and 25.70% YTD. U.S. GDP growth came in at just 1.6% in Q1, sharply below estimates of 2.4%, stoking stagflation concerns as inflation remains stubbornly high.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of April 30, 2024

U.S. yields surged after the first-quarter core PCE index release; it rose 3.7% YoY, well above the targeted 2% pace in the quarter prior. The 2-year Treasury yield closed the month at 5.04%, above the closely watched 5% level. The yield on the 10-year Treasury jumped to 4.68%. The two key rates remain inverted, and up considerably from where they started the year at 4.25% and 3.88% respectively. Because yields and bond prices move in opposite directions, the U.S. Aggregate and International Bond indexes fell -2.53% and -1.30%, respectively, in April, pulling their respective YTD returns into negative territory at -3.28% and -1.22%. Investors had been hoping that interest rate cuts would begin as soon as June, but this timeline has since pushed back at least to September after recent economic data suggests that inflation is persistent.

In early May investors will be bracing for earnings reports from the mega cap companies, as well as a jobs report and the latest Federal Reserve interest rate decision. The U.S. central bank is broadly expected to keep interest rates steady, but traders will be listening to see if Fed Chair Jerome Powell’s post-meeting comments strike a more hawkish tone after the recent spate of hotter inflation reports.

Overseas, European central bank members continued to support a June rate cut, and interest rate markets are forecasting three interest cuts in 2024. The Bank of Japan kept its policy rate steady after Tokyo’s April core inflation reading was lower than expected at +1.6%. The central bank also released its Q2 economic outlook, raising inflation estimates and downgrading GDP forecasts. The Japanese yen weakened to its lowest level against the U.S. dollar in 34 years as it surpassed ¥160 at one point in April. The U.S. greenback appreciated 1.49% in April and 4.86% YTD against a basket of international currencies.

The MSCI Emerging Markets index was one regional index to escape April’s selloff – gaining 0.45% in April amid a sea of red in global equity markets. MSCI China was the largest contributor to EM returns, as the index rallied 6.49% in April to pull its YTD return back into the black, up 4.10%. China reported better-than-expected GDP growth (+5.3%) for the first quarter, but industrial production and retail sales had slumped in March, suggesting a rocky road for the rest of the year. Finally, the International Monetary Fund raised its global growth forecast slightly but warned that the U.S.’s massive fiscal deficits and China’s government debt pose “significant risks” for the world economy.

Gold hit a record high of $2,431.29 in early April and gained 2.53% for its third consecutive winning month to bring YTD returns to 10.82%. The Bank of Korea has not made any gold purchases since 2013, but according to a report from Reuters, the central bank may consider buying the commodity in the mid- to long-term as a safe-haven asset. Oil fell 1.49% in April to bring its YTD return to 14.35%. In the Israel-Hamas war, the U.S. is pushing for a ceasefire to head off an Israeli offensive against Rafah, fearing an invasion will dramatically escalate the humanitarian crisis and regional tensions. Should a truce be accepted, geopolitical risks may ease in the oil market as the probability of a supply disruption out of the Middle East would lessen.

Bitcoin fell -14.05% in April to close the month at $59,868, its worst month since November 2022 when Sam Bankman-Fried’s FTX exchange collapsed. That said, Bitcoin is up 42.76% YTD, following its stellar 152.94% gain in 2023.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of April 30, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”