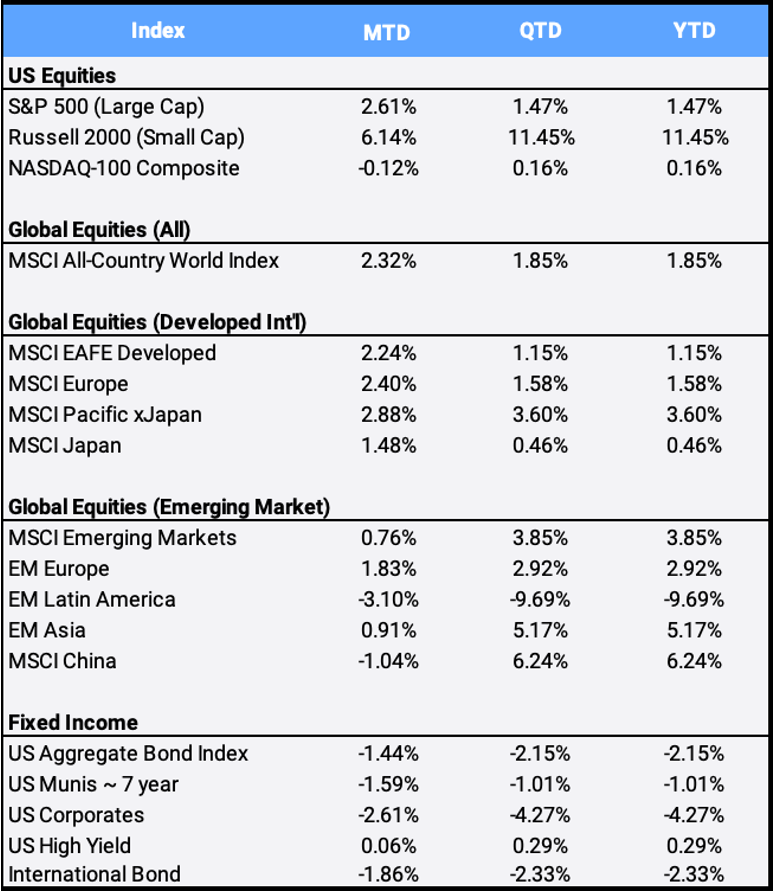

A runup in interest rates cooled a rally in global stocks this month. The MSCI All-Country World Index (ACWI) hit an all-time high on February 16 and was up over 6.60% mid-month, only to finish February with a more modest 2.32% gain. Inflation worries heightened, though, in expectation of an economic rebound to coincide with a global COVID-19 vaccination rollout. Just as markets closed for the month, Johnson & Johnson received emergency use authorization approval for its single-shot vaccine — a major milestone that added optimism to the global macroeconomic environment.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of February 28, 2021

U.S. Treasury yields have been surging, with 10-year yields finishing February at 1.41% — higher than before the pandemic hit. Global bond markets were spooked, with the U.S. Aggregate Bond Index and International Bond Index selling off 1.44% and 1.86% for the month respectively. Interestingly, the U.S. high-yield bond market held firm with a 0.06% gain, as the interest rate increase — adversely affecting bond prices — was offset by growing demand for higher-yielding risky assets.

The CBOE/S&P Volatility Index (aka the VIX), a gauge of market stress, dropped below its neutral level of 20 on February 12, coinciding with the early-month equity rally, but then rose to finish February at 27.95 after the interest-rate shock. The simultaneous selloff in stocks and bonds might indicate that the COVID-19 recovery hasn’t quite taken hold, and that investors remain anxious about the effect of increasing interest rates on global assets.

U.S. small-cap stocks posted their fifth positive month, gaining 6.14% in February to bring year-to-date returns to 11.45%. The large-cap S&P 500 Index was up 2.61% for February, bringing large caps into the black at 1.47% so far in 2021 — but the tech-heavy Nasdaq 100 slipped 0.12% last month and is relatively flat for 2021 with a 0.16% YTD return. As large-cap tech and defensive stocks remain in the back seat, the highly anticipated rotation into U.S. value shares appears to be gathering speed: The Russell 3000 Value index gained 6.07% in February compared with the Russell 3000 Growth index, up a mere 0.12%.

Gold fell 6.15% in February in its worst monthly loss since 2016. It was unusual to see the shiny metal sell off while whispers of inflation were sweeping across the markets — especially because the diversified Bloomberg Commodity Index gained 6.47% for the same period. For the year, gold is down 8.66% while commodities are up 9.27%.

Finally, no global asset market commentary is complete without acknowledging Bitcoin, which piled on a 31.84% gain in February to bring YTD returns to 57.51%. (That’s after a 2020 return of 305%.) The world’s largest cryptocurrency finished the month at 45,248, after hitting a new all-time high of 57,355 on February 21.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of February 28, 2021.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”