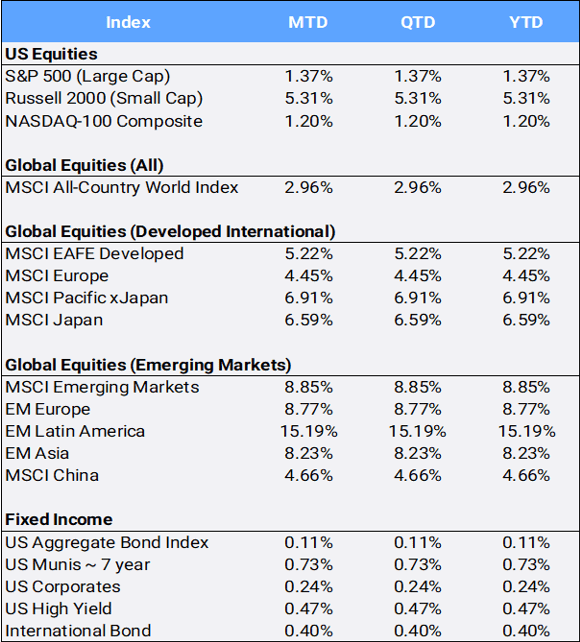

- Global stocks came out of the gates strong, climbing 2.96% in January following three straight years of gains: 22.34% in 2025, 17.49% in 2024, and 22.20% in 2023. The MSCI All Country World Index (ACWI) made seven all-time highs in the opening month of 2026. In the US, stocks faced rising volatility as investors grappled with the latest Federal Reserve decision, the nomination of Kevin Warsh as Jerome Powell’s successor, earnings reports from technology giants, and the looming threat of at least a partial government shutdown.

- The CBOE S&P Volatility Index (VIX), often referred to as “the fear index,” rose 16.66% to 17.44 from 14.95, where it closed last year. It traded as high as 20.99 intraday on January 20th, when President Trump’s pursuit of Greenland threatened to upend trade relations. Although tensions between the US and Europe eased somewhat by the month’s end, investors’ move toward international assets gained further momentum. Strong inflows continued in 2026, with developed markets gaining 5.22%, while emerging markets—which tend to benefit most from a weak dollar—surged 8.85% in January.

- The US Federal Reserve decided to hold interest rates steady. Chair Jerome Powell noted a clear improvement in the economic outlook and diminished risks to inflation and employment, while giving little reason to expect further rate reductions soon. The trading month closed on news of Kevin Warsh being nominated as the next Fed chair. Warsh, who served as a Fed governor from 2006 to 2011, has a reputation as an inflation hawk, although he has recently argued for moderate rate cuts. While many remain worried about the central bank’s independence, Warsh is seen as a pragmatist who is less dovish than some of his rivals for the role. The US dollar remained under pressure in January, slipping 1.35% after a 10.17% decline against a basket of international currencies in 2025 (its worst annual depreciation since 2003). Some believe that Warsh’s nomination may temper risks of US dollar debasement in the near term.

- Eight of 11 sectors gained in January, led by energy’s stellar 14.05% debut 2026 return. Materials and consumer staples followed, up 8.75% and 7.46%, respectively. Decliners included healthcare (-0.02%) and technology (-0.03%), while financials performed the worst (-2.41%). Disappointing reactions to big tech earnings, fresh inflation jitters, and concerns over the announcement of the new Federal Reserve chair put a damper on investor sentiment.

- Turning to corporate earnings, the latest batch of reports from technology companies produced mixed results. Shares of Meta Platforms jumped 8.55% MTD (month-to-date) on a strong forecast, while Microsoft plunged 11.03% MTD after reporting slowing cloud growth. Apple exceeded expectations on “staggering” iPhone demand, yet shares still slipped 4.55% MTD. Mega-caps Alphabet and Amazon are set to report in early February, along with other key technology companies such as Advanced Micro Devices, Palantir, and Qualcomm soon thereafter. However, the rally broadened beyond these large caps, with the S&P Mid Cap 400 and S&P Small Cap 600 advancing 4.05% and 5.61%, respectively, fueled by robust economic data and strong earnings. Further evidence of a “rotation trade” showed the Russell 3000 style components diverge, as value gained 4.62% and growth fell 1.30% MTD. In addition, the average S&P stock, as measured by the S&P 500 Equal Weight Index (SPW), gained 3.28% in January. Last year, the average stock was “only” up 9.34% compared to the 16.39% 2025 annual gain of the traditional market-cap-weighted S&P 500 Index.

- 2025 saw international stocks see their best outperformance versus US stocks since 2009, and asset flows continue overseas. Every developed market posted positive returns in January, and only three emerging market countries were in the red MTD, with India being the worst emerging markets performer, falling 5.10%. However, Korea and Colombia led this month, gaining 28.11% and 27.44%, respectively. Early in January, a US operation captured Venezuela’s President Nicolas Maduro, and attention has now shifted to a potential US-led effort to bring major oil firms back into the politically unstable country, which nationalized many of their assets in 2007 and has seen its oil output fall sharply in the past decade. MSCI Latin America was the best-performing region in January, gaining 15.19%. Crude oil was up 13.57%, while the broader, diversified Bloomberg Commodity Index gained 10.36%.

- Precious metals had a wild month following their impressive 2025 campaign that saw gold and silver up 64.58% and 147.95% in record-smashing rallies. Those two metals tumbled 8.95% and 26.36% on the last day of the month—their biggest plunge in decades—following the news of Kevin Warsh’s nomination. Traders dialed back expectations for policy easing and whispered of a “gamma squeeze” in options market trading. It was silver’s biggest single-day drop since 1950. Despite the last-day sell-off, both were up an impressive 13.31% and 18.89% for the month. Often referred to as the “gold and silver” of the crypto world, Bitcoin and Ethereum fell 3.98% and 9.27% MTD, respectively.

Disclosure Statement

Perigon Wealth Management, LLC (“Perigon”) is an independent registered investment adviser. Form ADV Part 2 is available upon request by calling 415-430-4140 or emailing compliance@perigonwealth.com. For additional disclosures, visit perigonwealth.com.

Past performance is not indicative of future results. Investments may lose value, and nothing contained herein should be construed as legal, tax, or investment advice, or as an offer or solicitation to buy or sell any security. Information is for educational purposes only and obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Data Source: Bloomberg Pricing Data, as of December 31, 2025.