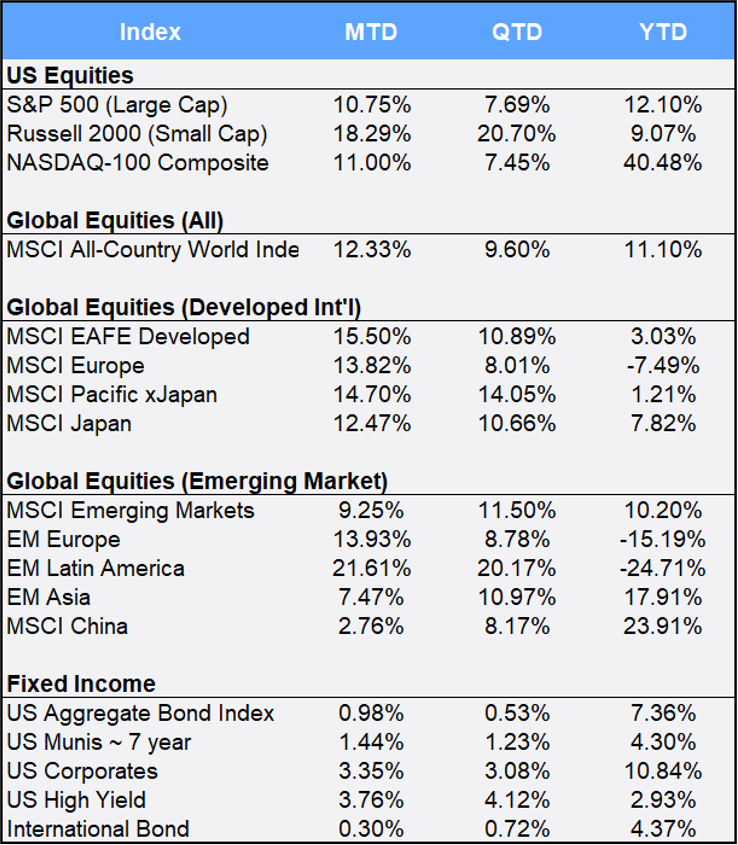

Global equities just experienced a November to remember: The MSCI All-Country World Index (ACWI) jumped 12.33% to record its best month since the index launched back in 1969, as investors rode a wave of upbeat news about impending COVID-19 vaccines. Two U.S. drugmakers, Pfizer and Moderna, both applied for Emergency Use Authorization with the U.S. Food and Drug Administration, and Britain’s AstraZeneca also announced strong efficacy data. In the U.S., the S&P 500, Nasdaq and Dow Jones industrial average all hit record highs this month, with the bellwethers gaining 10.75%, 11.00% and 11.84%, respectively. The Dow’s monthly gain was its best since 1987.

As the markets welcomed the vaccine news, a decisive victory for President-elect Joe Biden and the persistence of a divided Congress, the CBOE/S&P Volatility Index (aka the VIX) fell 45.90%, reversing its 44.18% October surge, and closed the election month at 20.57. The “fear index” remains stubbornly above 20, though, as traders see risks from a possible U.S. government shutdown, the uncertainty of further stimulus, a nearing Brexit and a growing global surge of COVID-19 infections.

U.S. small-cap stocks also posted their best month on record, screaming up 18.29% in November. The stocks’ outperformance over large caps was the largest since January 2000.

All 11 sectors finished November in the black. Energy stocks led the charge, up 28.28%, although for the year the sector remains the worst-performing in 2020 — off 35.72% for the year to date — and hard hit by pandemic-related travel restrictions. Similarly, crude oil spiked 26.68% for November, but the price is still down 25.75% YTD.

Overseas, the MSCI EAFE returned 15.50% in November. Concerns over new lockdown measures across Europe were outweighed by positive third-quarter GDP. France and Germany were among the largest positive contributors to index returns, gaining 22.93% and 17.16% respectively. Germany can thank a bullish month for the auto sector, with Daimler and BMW up 26.99% and 23.99% respectively. In France, banks BNP Paribas and Societe Generale showed monthly gains of 43.95% and 43.38% respectively, while Air France and Airbus soared 77.94% and 40.17% for the month.

Bond markets across the globe also rallied. The U.S. Aggregate and International Bond indexes rose 0.98% and 0.30% respectively. Both high- and low-grade corporate bonds also moved favorably, rising more than 3% for the month.

In precious metals, copper climbed 12.63% in November to a seven-year high. Gold, the traditional safe haven, closed November at 1,776.95, down 5.42% — marking its fourth consecutive monthly decline as well as its worst monthly drop since November 2016. Interestingly, Bitcoin rallied 39.92% to an all-time high of 19,378.61; the world’s largest digital asset has risen 170.72% in 2020.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of November 30, 2020.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”