Global Market Commentary at a Glance

MSCI ACWI all time high at +21.07% YTD

S&P 500 gain of +0.13%

Nasdaq saw the fall of the tech sector -4.76% MTD

10-year Treasury yield closed at 4.01%

European markets now sit at an impressive 30.32% YTD

Japanese stocks slipped 0.71%

Silver hit an all-time high at $56.50/oz

Bitcoin tumbled to 16.92% MTD

Global stocks finish flat but with record highs

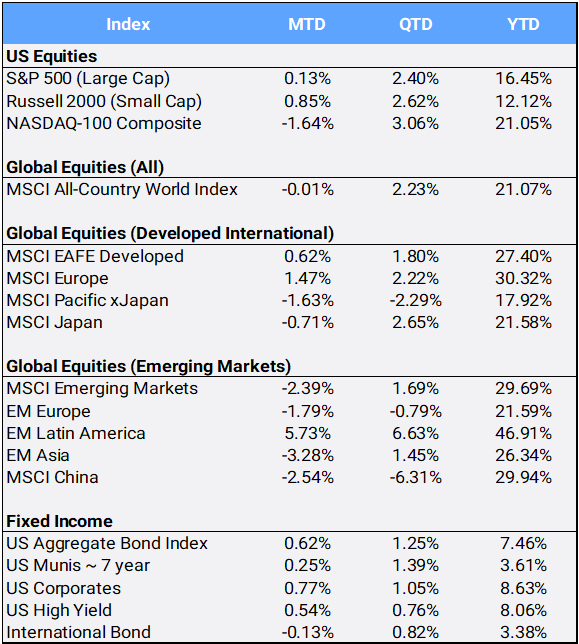

Despite slipping 0.01%, the MSCI All Country World Index (ACWI) has made 50 new all-time highs this year and is up 21.07% YTD – marking its best 11-month start of a year since 2019.

International stocks, excluding the US, as measured by the MSCI ACWIxUS index, are up 28.53% so far in 2025, marking their best January-to-November run since the coming out of the Great Financial Crisis in 2009.

S&P 500 and Nasdaq break their streaks

In the US, the S&P 500 was able to eke out a 0.13% gain this month to bring YTD returns to 16.45%.

Early November saw stocks sell off on concerns on forward growth concerns, market valuations, and growing AI-related debt accumulation. However, buy-the-dip investors defended technical support levels and were able to bring the large cap index into the black on the final day of the month. It was the first month the index failed to post a new closing high since May 2025 (there have been 36 YTD).

Meanwhile, the tech heavy Nasdaq 100 fell 1.64% MTD breaking its 7-month win streak. Eight of 11 sectors gained in November, with healthcare being the best (up 9.31%) while technology was the worst (-4.76%) as doubt swirled about the future profitability of AI companies.

Will we know the next Fed Chair?

November’s late rally in risk assets may have also been fueled in part by speculation that the White House could decide on the next Fed Chair before 2025 ends. The current frontrunner appears to be National Economic Council Director Kevin Hassett, and the potential dovish implications of his tenure could weigh on the US dollar as investors price in additional rate cuts.

The dollar depreciated 0.35% in November against a basket of international currencies and is down 8.32% YTD.

US Treasury yields eased

After comments from FOMC officials and moderate weakness in the limited economic data released, odds lifted for an additional rate cut this year to above 85%, as priced by fed funds futures. Fed Governor Waller and New York Fed President Williams both voiced support for lowering rates at the Fed’s upcoming December 9-10 meeting.

The US Aggregate bond index gained for the fourth month in a row, up 0.62% MTD to bring YTD returns to 7.46%. As prices and yields move in opposite directions, the 10-year Treasury yield, used as a reference rate on everything from mortgages, credit debt, and student loans, closed November at 4.01%, down from 4.08% in October and from 4.57% where it began 2025.

Rate-cut expectations lift small caps

The late month catch-up in economic reported numbers (after the government shutdown delayed most data release) boosted the probability of another rate cut this year, which typically benefits smaller companies the most. Since the April lows, the Russell 2000 small cap index has outperformed its large cap counterparts 42.01% versus 37.46% (S&P500 index) but still lags considerably YTD.

Value stocks outperformed gaining 2.48% MTD compared to their growth peers slipping 1.73% YTD However, growth is ahead gaining 18.19% compared to value’s 12.86% gain so far in 2025.

International equity markets are split

European markets extend gains as inflation cools

In international equity markets, the developed European region gained for the fourth month in a row, up 1.47% in November, and now stands at an impressive 30.32% YTD – helped by the Euro, appreciating for 12.01% vs the USD YTD. Inflation in Europe has been much more subdued and closer to its central bank target than prices in the US.

Japan faces rate-hike pressure

Japanese stocks slipped 0.71% this month, as Tokyo’s core CPI reading came in at 2.8% YoY, supporting increased calls for a near-term rate hike from the Bank of Japan. Early indications suggested that Japan’s annual wage negotiations lean toward solid pay hikes, which may give the central bank added confidence to raise rates.

Lastly on the international front, investors will also be watching ongoing developments in Ukraine- Russia negotiations for peace.

Big month for metals, while Bitcoin falls to April levels

Silver closed at an all-time high $56.50/oz, soaring16.04% in November, and the industrial metal is up 95.49% YTD.

Meanwhile, gold and copper also advanced 5.91% and 2.23% MTD to bring their 2025 return to 61.53% and 30.93% respectively. The diversified Bloomberg commodity index gained 3.20% in November to bring its YTD return to 16.15%.

Cryptocurrencies remained under pressure, with Bitcoin tumbling 16.92% in November to levels last seen in April. The YTD return of the world’s largest digital coin is now in the red at down 2.99%.

Disclosure Statement

Perigon Wealth Management, LLC (“Perigon”) is an independent registered investment adviser. Form ADV Part 2 is available upon request by calling 415-430-4140 or emailing compliance@perigonwealth.com. For additional disclosures, visit perigonwealth.com.

Past performance is not indicative of future results. Investments may lose value, and nothing contained herein should be construed as legal, tax, or investment advice, or as an offer or solicitation to buy or sell any security. Information is for educational purposes only and obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Data Source: Bloomberg Pricing Data, as of October 31, 2025.