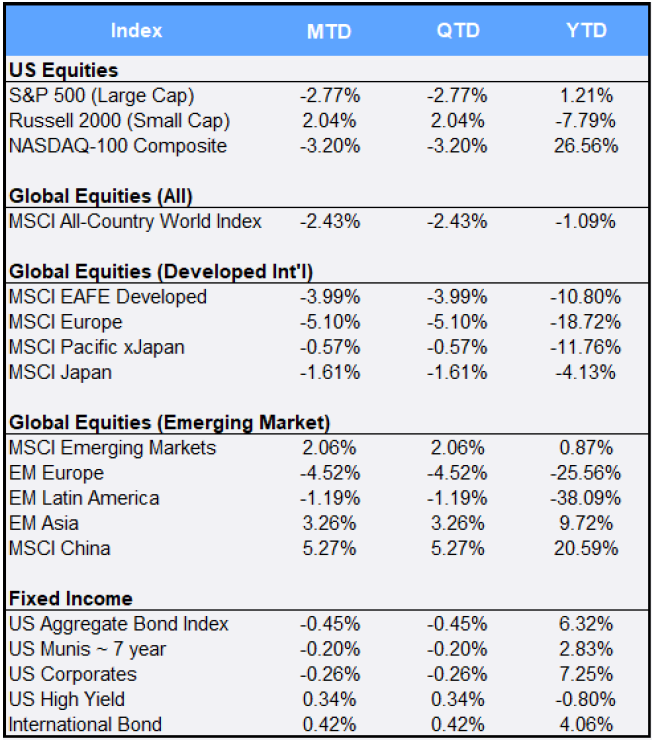

Earlier hopes for both a vaccine and U.S. stimulus finally faded in October, as investors became frustrated with the lack of progress on both fronts. Global equities sold off, with the MSCI All-Country World Index (ACWI) falling 2.43%. In the U.S., the bellwether indices of the S&P 500, Dow Jones, and Nasdaq fell 2.77%, 4.61%, and 3.20% respectively in October. The drops left the benchmarks down 8.68%, 10.32% and 11.01% from the all-time highs reached earlier this year. The Dow Jones suffered its worst monthly performance since March.

The CBOE/S&P Volatility Index (aka “the VIX”) gained 44.18% to close October at 38.02. The VIX is often referred to as an uncertainty (or fear) index, and investors are certainly grappling with questions around incoming election results and potential policy changes. Analysts expect a Democratic victory would mean a larger fiscal stimulus and small-cap stocks, which are believed to be best positioned to benefit from a possible December stimulus, outperformed their large-cap peers to gain 2.04% this month.

For 2020 as a whole, technology remains the best-performing sector, up 22.13% year to date. Yet valuation concerns brought the group under the microscope as its largest firms began reporting earnings — making tech the month’s worst-performing sector with a drop of 5.10%. The second worst was the energy sector, which fell 4.27% for the month. Energy stocks have been hit hard by the travel restrictions brought on by the COVID-19 pandemic, and the sector has lost over 60% of its value relative to the S&P 500 over the last couple of years — the worst sector plunge dating back to 1928. The lone sector in the black this month was utilities, gaining 5.04% in October.

In international developed markets, the MSCI EAFE fell 3.99% in October. MSCI Europe again weighed down overall markets: The region fell 5.10% as surging Covid-19 cases sparked further lockdowns across the continent.

China equities climbed 5.27% as the polls favored presidential nominee Joe Biden, who is expected to have less of a hardline stance on tariffs than current President Donald Trump. The largest county in the MSCI Emerging Index was also the largest monthly contributor, with the broader group gaining 2.06% for October and bringing YTD 2020 returns into the black at 0.87%. China is the best-performing emerging markets country for the year so far, up 20.59%.

The 10-year Treasury yield closed the month up at 0.87%, booking its largest monthly climb in two years. The uptick in rates saw the broader U.S. Aggregate Bond Index slip 0.45%. High-yield bonds gained 0.34% for the month, however, as so-called junk bonds remain one of the few places left in fixed income offering yields above 5%. Meanwhile, gold spot prices closed the month at $1,878.81 per ounce, down 0.37% in October with the first three-month decline since April 2019.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of October 31, 2020.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”