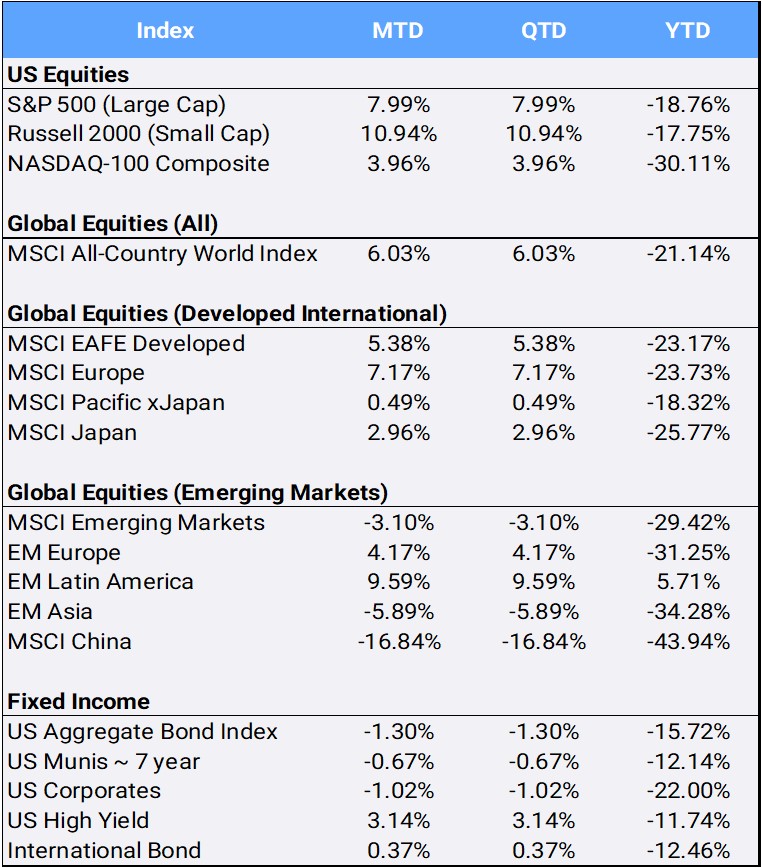

Global Equities rallied 6.03% in October following September’s worst monthly showing since the Coronavirus pandemic shook global markets in March 2020. Still, the MSCI All-Country World Index remains in bear market territory and is down 21.14% on the year – marking its third-worst 10-month start to a year since the 2008 financial crisis and the 2001 dot-com collapse. In the U.S., equity indexes finished higher following a GDP report that came in above expectations growing 2.6% in the third quarter. Small-cap stocks outperformed their larger-cap market peers in October, returning 10.94% and 7.99% respectively. Meanwhile, the Dow Jones Industrial Average finished with its best October performance ever, gaining 13.95%; it was the Dow’s largest monthly gain since January 1976.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of October 31, 2022

The U.S. bond markets continue to sell off thanks, to ongoing interest rate hikes (yields and prices move in opposite directions). The U.S. aggregate bond market fell 1.30% in October and is now down 15.72% so far in 2022. For perspective, the worst annual year for the “U.S. AGG” was in 1994’s “great bond selloff” which saw the index drop 2.92%. The Federal Reserve raised interest rates an additional 75 basis points at its November 2nd meeting, as widely anticipated. This was the sixth rate hike of the year as the central bank fights to curb record high inflation. The 10-year Treasury yield, which started the year at 1.51%, finished October at 4.05%.

Outside the U.S., the European Central Bank delivered a second straight 75bps hike, while the Bank of Canada surprised with a smaller-than-anticipated half-point raise, citing an economy that is likely to stall in upcoming quarters. The Bank of Japan maintained its ultra-low rates as expected but announced a massive $200B stimulus package to offset rising material costs. In Europe, Germany’s CPI climbed to 10.4% YoY. Finally, Australia’s inflation hit a 32-year high last quarter, raising pressure on the Reserve Bank of Australia for more aggressive tightening. Still, international bonds were able to inch forward 0.37% in October, marking only their second month of gains in 2022. Conveniently, it was only the second time the U.S. dollar slipped this year, depreciating 0.53% this month, but still up 16.57% YTD against an international basket of currencies.

All eleven sectors of the U.S. stock market saw gains in October, with energy again leading the charge in October, up 24.97%. Energy also leads YTD, soaring 67.39% so far in 2022. Oil output in the U.S. climbed to nearly 12 million barrels per day, the highest since the onset of the COVID-19 pandemic. President Joe Biden has called on oil and gas companies to invest some of their record profits in lowering costs for American families. Previously, he has pushed these companies to raise production rather than use profits for share buybacks and dividends. He called for Congress to investigate a “Windfall Tax” for oil companies, declaring “It’s time for these companies to stop war profiteering.”

Crude oil gained 8.86% in October and is up 15.05% YTD, while natural gas slipped 6.07% this month, but remains up 70.38% so far in 2022. Gold is highly sensitive to rising interest rates, as this increases the opportunity cost of holding it, and fell 1.63% in October. YTD, gold is down 10.70%. A diversified basket of commodities, as marked by the Bloomberg Commodity Index, gained 1.99% in October to bring YTD returns to 15.83%. Bitcoin, the largest cryptocurrency, gained 5.05% in October, but is down 55.96% YTD.

Sharply rising mortgage rates have depressed the housing market, as new home sales plunged 11% MoM in September and pending sales sank 10.2%. Home prices have started to come down but not nearly enough to offset higher borrowing costs. The real estate sector managed a 2.05% gain in October, but is still down 27.39% YTD.

Disappointing earnings announcements from market stalwarts Alphabet, Amazon, and Meta Platforms saw those mega-cap tech stocks get slammed after reporting. The Nasdaq Composite managed a 3.96% gain, but YTD remains sharply down 30.11%. Value continued to outperform Growth in October as their Russell 3000 style indexes were up 10.25% and 6.00%, with YTD returns at -11.03% and -26.90% respectively.

In the U.K., the pound and bond markets have calmed down after Rishi Sunak took over as prime minister, replacing Liz Truss. Sunak is considering raising taxes to help balance the budget. British stocks gained 5.94% in October, while the broader based MSCI EAFE climbed 5.38%. For the year-to-date, they are down 16.68% and 23.17% respectively.

Chinese President Xi Jinping cemented a historic third term at the Chinese Communist Party Congress. He indicated no major shift in the zero-COVID strategy and reiterated that reunification with Taiwan is a government priority. China is the largest downdraft to the MSCI Emerging Markets Index both on the month and the year, as local stocks have fallen 16.84% and 43.94% respectively. Brazil, on the other hand, is the largest positive contributor to index returns so far in 2022, up 8.62% in October and up 21.15% YTD. Brazilian shares rose following the electoral victory of left-wing candidate Luiz Inacio Lula da Silva in the October 30th presidential election.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of October 31, 2022.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”