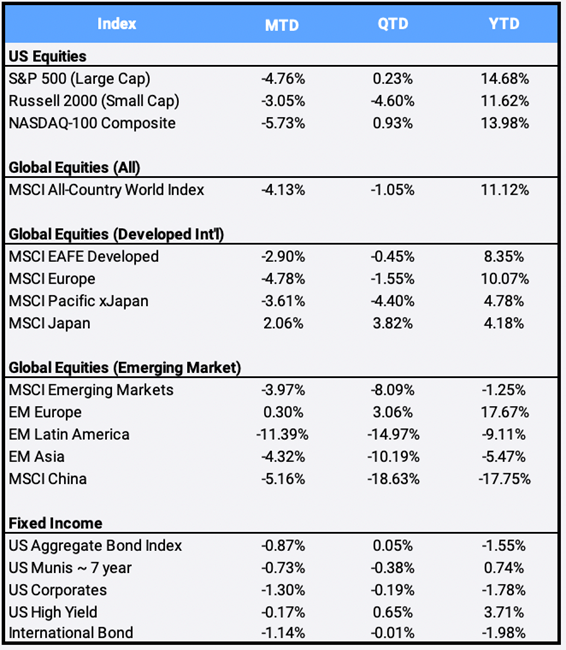

Global Equities fell -4.13% in September as rising rates, inflation fears and concerns about the Chinese property market shook investors. After a rough month, the MSCI All Country World Index (AWCI) slipped -1.05% during the quarter but remains up 11.12% YTD. In the US, the S&P 500 index eked out a positive 0.23% Q3 return to mark its sixth consecutive quarterly gain, while the Nasdaq posted its first quarterly loss since March 2020, falling -1.05%. September brought US markets to their worst selloff since the Coronavirus selloff in March 2020, as the S&P and Nasdaq fell -4.76% and -5.73% during the month on concerns on inflation and supply chain issues, which brought their YTD returns down to 14.68% and 11.62% respectively so far in 2021.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of September 30, 2021

International equities were roiled by fears that Chinese real estate giant the Evergrande Group might not be able to meet its debt obligations; Chinese authorities showed reluctance to bail out the nation’s second largest property developer. The developed and emerging market MSCI indexes dropped -2.90% and -3.97% in September to post negative Q3 returns of -0.45% and -8.09% respectively. International returns were also hurt by an appreciating US dollar, with an international basket of currencies down -1.40% MTD, -1.71% QTD and -3.80% YTD.

Not surprising given the Evergrande headlines, China was the 2nd worst performing equity market in Q3, falling -18.63% behind only Brazil’s -22.44% drop this quarter. Latin America’s largest country has been marred by uncertainty over potentially harmful policy moves by President Jair Bolsonaro, jockeying for position in next year’s election as his popularity plummets.

During their September meeting, the US Federal Reserve’s Open Market Committee (FOMC) lowered its outlook for GDP growth to 5.9% this year, down from the June forecast of 7%; inflation was revised upward to 3.7% from 3%. With prices potentially remaining elevated and the labor market moving toward full employment, uncertainty looms over the timing of rate hikes and when and how quickly the Fed will wind down its aggressive asset purchases. The ten-year Treasury rate inched up to 1.52% this month, up from 1.30% at the end of last month; it had ended last quarter at 1.45% and 0.93% at the start of the year. With yields moving inversely to prices, the US Aggregate Bond index fell -0.87% in September to end the quarter basically flat at 0.05%, and down -1.55% YTD.

West Texas Intermediate Crude oil rose 9.5% in September and its surge aided the Energy sector, up 8.97%. Financials, the second-best sector, fell -1.85%. Materials was the worst performing sector, sinking -7.20% this month, while the Technology sector sold off -5.78%. For this quarter, financials posted the best return, up 2.74%, while industrials were the worst, falling -4.23% in Q3. So far in 2021, Energy leads, up 42.23% YTD, while Consumer Staples is the YTD laggard, up only 3.95% YTD.

Bitcoin sold off -7.60% in September, as China declared all cryptocurrency transactions illegal. Still, the world’s largest cryptocurrency gained 25.59% in Q3, and remains up 49.80% YTD so far in 2021.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of September 30, 2021.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”