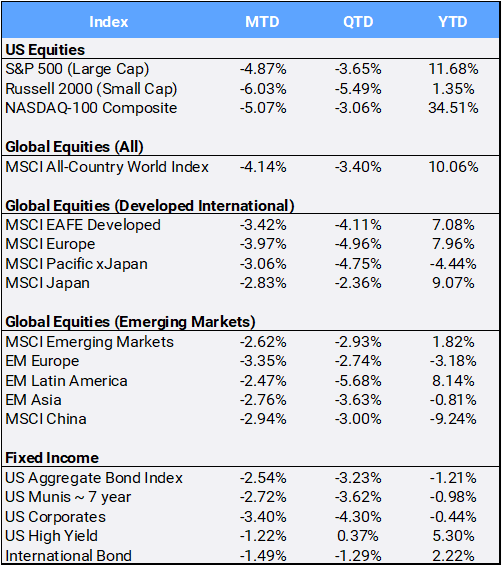

Global equities fell 4.14% in September, bringing down Q3 returns to negative 3.4%, the first quarterly decline in the past three quarters. Year to date however, the MSCI All Country World Index (ACWI) is up 10.06%. In the US, the S&P 500 index slumped -4.87% in a turbulent September dominated by the looming threat of a government shutdown, which was only averted at the very last minute, and only temporarily at that, with a 45-day funding bill. Year to date, the S&P 500 is up 11.68% despite falling -3.65% in Q3. Anxiety over the political standoff was evident in the options markets, as the CBOE Volatility Index (VIX) surged 29.11% to end the month at 17.52.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of September 30, 2023

Stocks have been pressured by the rapid resumption of the interest rate rally. The US 10-year treasury yield, which started the year at 3.87%, ended Q2 at 4.11% and has now ticked up to 4.57%, its highest level since 2007 despite modest progress on inflation. The core personal consumption expenditures (PCE) price index rose 3.9% on an annual basis in August, its lowest level in two years and down from 4.3% in July. As interest rates rise, bond prices drop; and global bond markets sold off violently and the US aggregate index (AGG) fell 3.23%, ending Q3 with returns in the red at -1.21%.

Interest-rate-sensitive stocks were among the worst performers for the quarter. Real Estate was the worst sector in September, down -7.25% for the month and 2nd worst for Q3 at -8.90%. In last place for Q3 was Utilities, down -9.25%. Coming into September, Technology was leading year-to-date returns, only to drop -6.45% in September. Year-to-date Tech is still up 32.64% which is impressive, second only to Communication Services at +37.82%YTD return. Facebook parent Meta is the highest contributor to sector returns, up 149.63% on the year.

A key point to note in stock returns is the unevenness. Within the S&P 500’s 11.68% gain, the average stock in the index is up only 0.27% YTD as measured by the equal-weight S&P500 index (Ticker SPW). Beyond large and megacap stocks, the S&P 400 MidCap and S&P 600 SmallCap indexes fell -4.58% and -5.35% respectively in Q3 to bring their YTD returns to 2.95% and 0.54%.

The US national debt reached $33 trillion for the first time (for reference, the S&P 500’s market value is ~$36 trillion), and Moody’s Investor Service warned that a government shutdown could hurt the U.S. government’s ‘AAA’ rating. Still, the US dollar marched on, appreciating 2.47% in September against a basket of international currencies, up 2.56% YTD.

Overseas, headline euro zone inflation fell to two-year lows, at 4.3% YoY in September. Germany’s import prices recorded their largest year-on-year decline since 1986, considered a positive forerunner for consumer prices. Australia’s core CPI eased, likely enough to keep central bank rates steady. Lastly, Bank of Japan Governor Ueda said that strong wage growth and consumption, rather than rising import costs, would be the keys to monetary policy changes; the central bank maintained its ultra-loose policy citing “extremely high uncertainties” on the global growth outlook. Of the Developed countries in the MSCI EAFE index, (up 7.08% YTD), Japan and Germany are the largest contributors to 2023 returns, gaining 9.07% and 8.79% respectively.

In Emerging Markets, China equities continue to weigh on MSCI EM overall returns, falling 3.00% in Q3 and down 9.24% YTD. Weighing on investor confidence has been the suspension of trading shares in China Evergrande Group, whose founder is being investigated over alleged “illegal crimes”. Creditors are becoming increasingly concerned about the group’s prospects amid an uncertain debt revamp plan and liquidation risk. Still, while the MSCI EM index fell -2.93% in Q3, it remains up 1.82% YTD.

In Commodities, crude oil prices jumped above $95 per barrel before pulling back to finish September at $90.79 (up 8.56% for the month) as US inventories hit a 14-month low coupled with OPEC production cuts. That said, at the beginning of July oil was hovering at $70.64/barrel and the talk was of preparing for a “hard landing” and recession. The Energy sector was up 2.43% in September, the only sector in positive territory for the month and one of only two in the black for Q3 at +12.27%. Consumer Services was the other, up 1.05% QTD.

Precious Metals have not been living up to their name, with gold and silver down -4.72% and -9.26% respectively in September and down -3.68% and -2.61% for Q3. YTD gold is up 1.35% and silver down -7.41%. The diversified Bloomberg Commodity Index fell 0.69% in September, but still was able to rally 4.71% in Q3 thanks in part to oil although it is down -3.44% so far in 2023. Bitcoin gained 3.42% in September to close at 26,967– a long way from its November 2022 low of 15,760 2022 (up 62.27% YTD) but further still from its 2022 open at 47,733.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of September 30, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”