Sustainable Investing

Improve your financial future – and the world around you.

Why sustainable investing?

At Perigon, we strive to empower you with choice. We achieve this by understanding the full picture of your financial life, including how we can align your portfolio with your values. We consider your personal goals and your well-being in every decision we make.

Let us show you how your values can play a role in your investment strategy.

What is sustainable investing?

It’s all about investing for competitive returns with your values in mind. A number of similar terms are used to describe this approach, like ESG, impact, and socially responsible investing. Each has its own nuance, but they all consider factors that go beyond the balance sheet when assessing an investment.

How does it work?

Sustainable investing supports more resilient portfolios and healthier, smarter capitalism through shrewd capital allocation, improved risk management, and proxy voting.

This holistic approach helps us better understand a company’s overall stability, opportunity to create shareholder value, and exposure to critical business risks. Simply put, this more comprehensive picture can help inform sound investment decisions and allows us to tailor your portfolio to reflect your values.

Related read: When sustainable investing outperforms, an article by Bud Sturmak

Aligning with your values

Sustainable investing at Perigon means aligning part or all of your portfolio with your values. You can reduce exposure to select companies or industries, and you can even target investments that generate positive impacts. There are a number of paths we can take to strive to you earn competitive returns while making a difference.

See Perigon At Work In This Latest Case Study

Case Study: How A Personalized Impact Report Became A Catalyst For Sustainable Investing

Following a liquidity event, a prospective client engaged Perigon to understand more about our customized investment approach and explore how they could benefit. At Perigon we collaborate, listen and learn, and it is through this engagement where we gained insights into this client’s values as well as their goals and uncovered that they showed a committed interest in the environment.

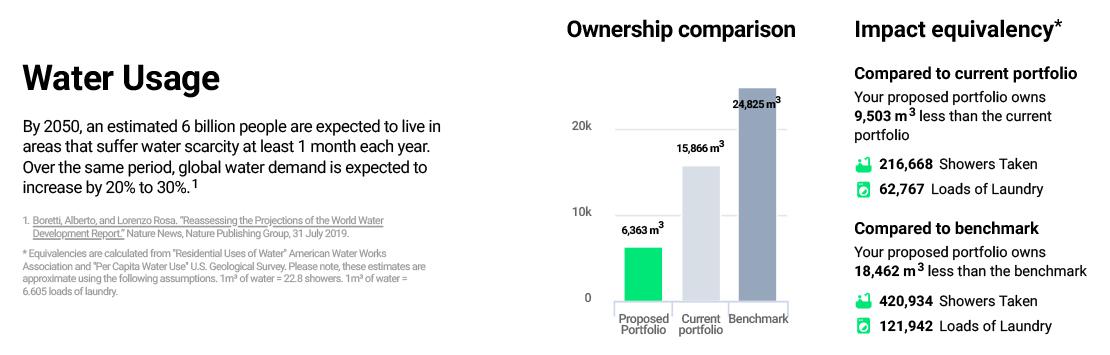

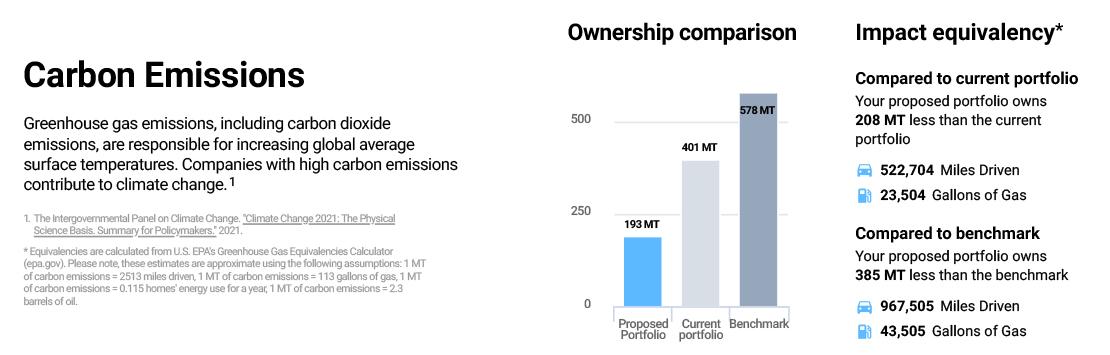

To show this prospective client how they could integrate sustainable investing into their portfolio, we offered to produce an impact report to measure the sustainability of the client’s current investments. We also compared the impacts of the current portfolio to a Perigon proposed portfolio that integrated this client’s desire to consider the environment in investment decisions.

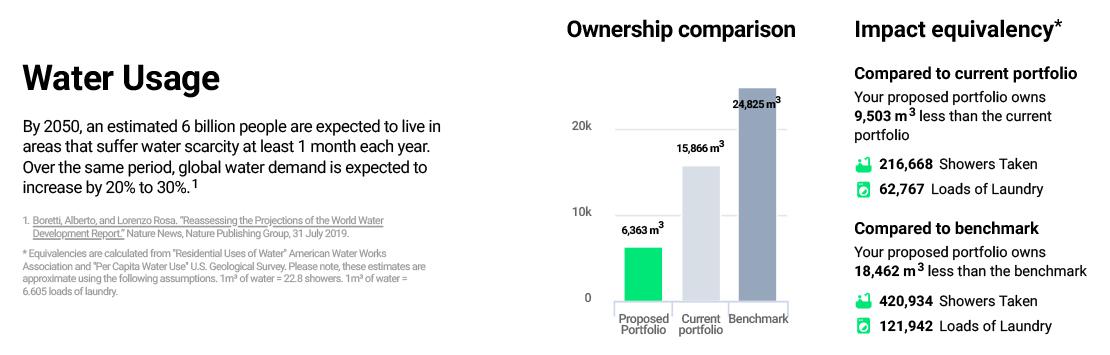

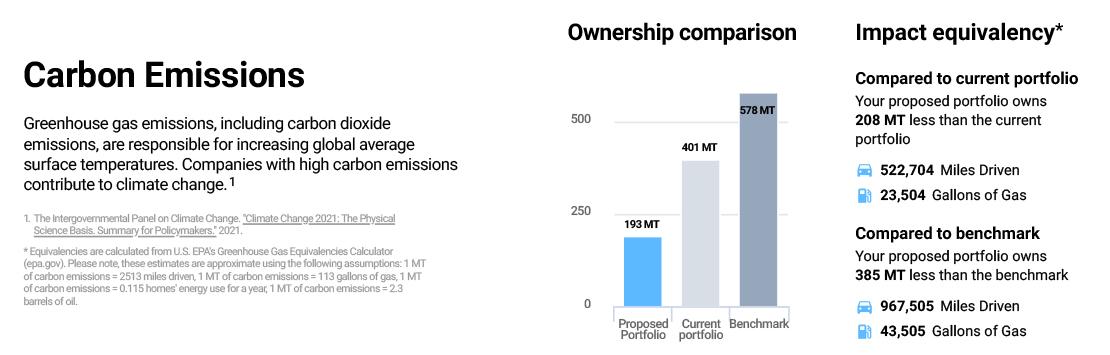

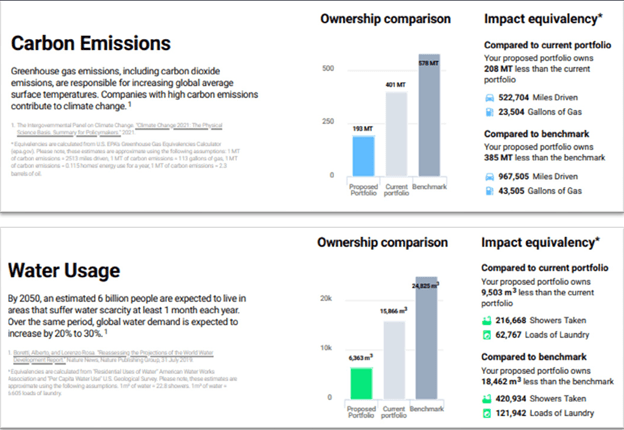

What we found through the impact report and comparing current and potential portfolio allocations was that we could significantly lower exposure to carbon emissions and lower usage of water, among other metrics. In addition, Perigon’s proposed portfolio included a proxy voting policy that would support driving positive environmental impacts on companies held in the portfolio.

Result: We are proud to say, this prospective client is now officially a Perigon client.

Our approach uses leading-edge public and private market solutions to customize portfolio themes that matter most to you, including:

Climate Change and Carbon Reduction

Sustainable Agriculture

Clean Energy

Poverty Reduction

Diversity, Equity, & Inclusion

Affordable Housing

Gender Equality

Equitable Education

What issues do you feel passionate about?

We’ll assess your portfolio and show you in simple terms how your investments really stack up against your values.

Disclosures

Perigon Wealth Management, LLC (“Perigon”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940, as amended. For additional information, visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov and search Perigon’s CRD #131037.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

When an investment process considers environmental, social, and governance factors (“ESG”), the advisor may choose to avoid investments that might otherwise be considered or sell investments due to changes in ESG risk factors as part of the overall investment decision process. The use of environmental, social, and governance factors may impact investment exposure to issuers, industries, sectors, and countries, potentially resulting in higher or lower returns than a similar investment strategy without such screens.

This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, or tax advice, or a recommendation or solicitation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Investing entails risks, including possible loss of principal. This document should not be construed as a recommendation to purchase or sell any particular securities. Market conditions can vary widely over time and can result in a loss of portfolio value.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Case Study: How A Personalized Impact Report Became A Catalyst For Sustainable Investing

Following a liquidity event, a prospective client engaged Perigon to understand more about our customized investment approach and explore how they could benefit. At Perigon we collaborate, listen and learn, and it is through this engagement where we gained insights into this client’s values as well as their goals and uncovered that they showed a committed interest in the environment.

To show this prospective client how they could integrate sustainable investing into their portfolio, we offered to produce an impact report to measure the sustainability of the client’s current investments. We also compared the impacts of the current portfolio to a Perigon proposed portfolio that integrated this client’s desire to consider the environment in investment decisions.

What we found through the impact report and comparing current and potential portfolio allocations was that we could significantly lower exposure to carbon emissions and lower usage of water, among other metrics. In addition, Perigon’s proposed portfolio included a proxy voting policy that would support driving positive environmental impacts on companies held in the portfolio.

Result: We are proud to say, this prospective client is now officially a Perigon client.