As we reflect on the first half of 2025, markets have delivered a lesson in resilience—and a reminder of the importance of staying diversified and disciplined through uncertainty.

A Volatile Yet Positive Start to the Year

Global equity markets navigated a bumpy path in the first six months of the year, marked by a return of volatility not seen since 2020 and 2008. After hitting new highs in February, U.S. stocks experienced sharp declines in April as concerns about “Liberation Day” tariff announcements rattled investors.

The S&P 500 fell more than 10% over two days in early April and came near bear market territory (a decline of 20% since a recent high), only to recover swiftly after a temporary pause in tariff implementation was announced. By midyear, the S&P 500 had gained 6.2%, while developed international and emerging markets delivered stronger returns of 19.9% and 15.6%, respectively.

Bond markets also offered positive performance, with the Bloomberg U.S. Aggregate Bond Index up 4.0% as of June 30, supported by stable Fed policy and modestly lower yields. Meanwhile, the U.S. dollar weakened significantly—down over 10% relative to a basket of major currencies in its worst half-year showing since 1973. This currency movement provided a significant tailwind for U.S. investors in foreign equities, underscoring the value of global diversification.

| Return since Tariff Announcement (4/2/2025-6/30/2025) |

First Half 2025 Return (12/31/2024-6/30/2025) |

|

| US Large Cap Stocks (S&P 500 Index) |

9.8% | 6.2% |

| International Developed Stocks (MSCI EAFE Index) |

11.1% | 19.9% |

| Emerging Market Stocks (MSCI Emerging Markets Index) |

11.1% | 15.6% |

| US Bonds (Bloomberg U.S. Aggregate Bond) |

1.0% | 4.0% |

| Diversified 70% Stock 30% Bond Portfolio* | 7.4% | 7.8% |

* Comprises: 50% iShares Russell 3000 ETF (IWV), 20% SPDR MSCI ACWI ex-US ETF (CWI), 30% Schwab US Aggregate Bond ETF (SCHZ) Source: YCharts

Tariffs and Inflation: A Dynamic Backdrop

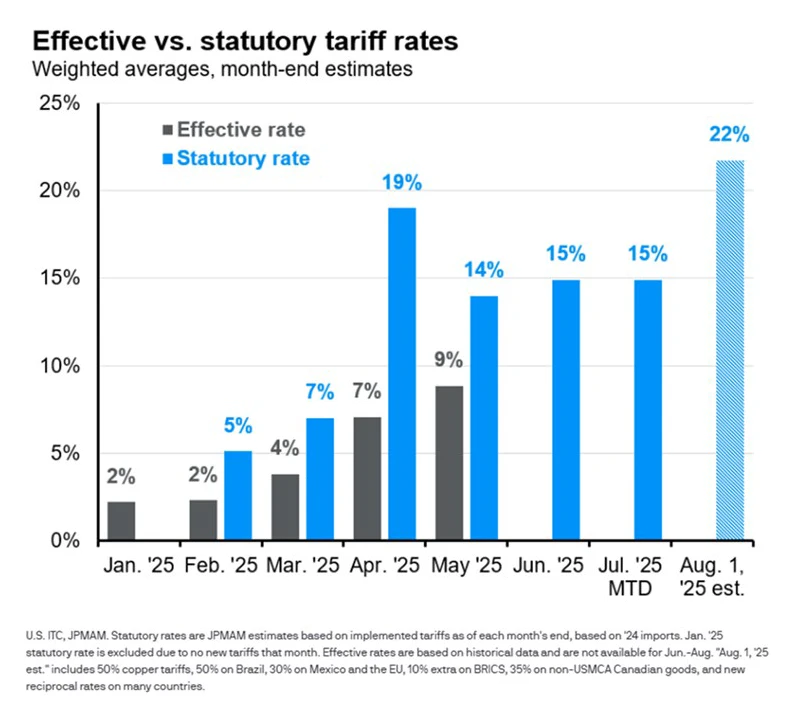

The policy environment has been a key driver of market sentiment. The new U.S. presidential administration entered office with a hardline stance on trade, threatening and imposing high tariffs on multiple countries. Over time, the announcement of tariff pauses to allow time for negotiations, exclusions for certain sectors, and businesses changing the countries they import from appears to have dampened the impact. The chart below from J.P. Morgan shows an estimate of the actual effective tariff rate on imports versus the announced statutory rate.

With the July 9 deadline for tariff pauses behind us, there has been a new slew of tariff announcements from the U.S. administration that bring the estimated statutory tariff rate back up to 22% in August. The stock market appears unfazed by these announcements—perhaps because the expectation is that the effective tariff rate will be lower due to some combination of negotiations, “TACO” (Trump Always Chickens Out), and/or exclusions for certain sectors.

Another explanation for market sanguinity is that the expected stimulative impact of the “Big, Beautiful Bill,” passed earlier this month, eclipses any negative impact of tariffs.

The bill extends corporate tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA), reduces taxes on tips and overtime, raises the state and local tax (SALT) deduction, and reduces spending on Medicaid, food assistance, and other social safety-net programs.

Yet the ripple effects of tariffs on inflation are starting to show. The Consumer Price Index (CPI) revealed signs of tariff-related inflation, with core prices rising 2.9% year over year in June—above the Federal Reserve’s 2% target. Economists expect continued tariff-driven inflation in July and August; June likely reflected initial pass-through from prior inventory stocking. It is important to note, though, that the inflation-related impact is expected to be a one-time hit to CPI. The challenge is that the ultimate trajectory of tariff policy remains uncertain, leaving investors to navigate a landscape where shifting trade dynamics and price pressures could influence both corporate earnings and consumer behavior.

The Value of Discipline and Diversification

The first half of 2025 reaffirmed timeless investment principles. Staying invested through April’s turbulence allowed portfolios to participate in the subsequent rebound. International diversification, in particular, helped cushion volatility, with international equities outperforming U.S. stocks by a wide margin for the first time in years.

Looking Ahead

As we enter the second half of the year, uncertainty around trade policy and inflation remains high. We continue to believe that a globally diversified, balanced portfolio is the best way to pursue long-term goals. Staying focused on your financial plan, rather than short-term market noise, remains our north star.

We remain committed to helping you navigate these shifting currents with a steady hand.