This overview is intended to be high-level and cover and a few key details to help in your understanding of implementation rules for ROTH vs. Traditional IRA’s.

BY: Thomas Manetta, Wealth Advisor

TOPLINE:

Contributions for ROTH IRA’s are made with after-tax dollars and grow tax free. Contributions for Traditional IRA’s can receive a tax deduction in the year they are made and grow tax-free.

It’s often assumed that a ROTH is best for those who think their taxes will be higher later and a Traditional IRA should be used if you assume the opposite and your taxes will be lower later in life.

It’s important to have a Wealth Advisor that knows how to get you the most from these types of retirement accounts.

The biggest difference between a ROTH and a Traditional IRA is the treatment of taxes upon distribution.

No matter where you are in your life’s journey, it is never too late to start planning for retirement. Even the smallest decisions you make today can have the biggest impact on your future.

While you might already be invested in an employer-sponsored plan, an Individual Retirement Account (IRA) allows you to supplement your retirement savings and to also potentially save on taxes as well.

There are different types of IRA’s too, with different rules and benefits. With a ROTH IRA, you contribute after-tax dollars, your money grows tax-free, and penalty and you generally make tax and penalty-free withdrawals after age 59 ½.

With a Traditional IRA you contribute “pre” or after-tax dollars and the contributions you make to the account may entitle you to a tax deduction each year.

The chart below show the contribution limits and differences between a ROTH (left) and Traditional IRA (right):

Contributions Come From:

After-tax dollars

Max Contributions for 2023:

$6,500 ($7,500 if you are over age 50)

For tax year 2022: $6,000

($7,000 if you are over age 50)

Contributions Eligibility:

Those with earned income below a certain level

Contributions Age Restriction:

None

Contributions Come From:

Pre- or After-tax Dollars

Max Contributions for 2023:

$6,500 ($7,500 if you are over age 50)

For tax year 2022: $6,000

($7,000 if you are over age 50)

Contributions Eligibility:

Anyone with earned income

Contributions Age Restriction:

None

Chart source: Charles Schwab

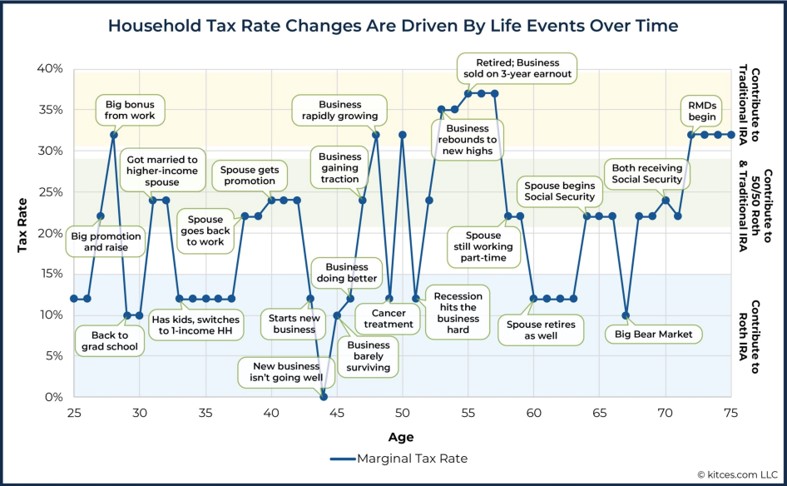

But here’s the thing: you are asking the wrong question. It is never that easy to just look at those limits and assume a certain tax rate in the future and make your decision. That’s because life happens and people go through things which are often unpredictable and sometimes tragic. Look at this wonderful chart from Michael Kitces below. It’s more than likely that you have gone through or will go through some or a lot of these changes or challenges in your lifetime.

We all have behavioral biases that are best dealt with from an objective third party. Effective planning, the kind that compounds over time, means that you must make tough decisions when times are tough AND when fortune shines upon you.

I listened to a debate recently on Twitter between two younger advisors who were, rightly I think, focused on these extremes in peoples lives and how tax rates can dramatically change in the client’s favor.

But what they didn’t discuss was how difficult it can be to address these difficult events with a client when they happen.

- Losing a business or going through an unforeseen terminal illness can be extremely difficult on its own. Asking a client to make changes to their financial plan during these times can be hard to do.

- At the other extreme, like the successful sale of a business or big bonus can be equally difficult as well.

What should never get lost in the conversation is how valuable it can be to have someone to talk to during these times who you trust and who has your best interests in mind. Having an advisor who has been through some of those things personally can make all the difference.

This information does not constitute legal or tax advice and should not be used as a substitute for the advice of a professional legal or tax advisor. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor. Perigon Wealth Management, LLC (“Perigon”) is a registered investment adviser. More information about the firm can be found it its Form ADV Part 2 which is available upon request by calling (415) 430-4140 or by emailing compliance@perigonwealth.com.