As Russia invades Ukraine, the worst-case scenario has materialized. So, as I start to think about various elements, I ask myself, “where do we go from here?”

The President is expected to speak early today, and the EU has an emergency summit this afternoon (6:00 pm CET). Early discussions by European countries are demanding carve-outs for energy, financial transactions, luxury goods, and more. The single biggest question will be SWIFT, essential for trade (particularly energy). This meeting will be a big test of European unity.

I suspect macro traders will look for any opportunity to start fading price action. A decision not to include SWIFT in sanctions or a general (weak) package. Or if Russia can take the capital of Ukraine quickly.

The tensions in Ukraine will push the Fed’s geopolitical risk index to extreme levels. Russia is a net importer of energy into the U.S. and will continue to raise gas prices at the pump. This could continue to put upward pressure on inflation (CPI) as transportation costs can affect the prices of goods. It would also cause a slowing of the economy as the cost of fuel erodes the discretionary budgets of most consumers.

The combination of inflation and potentially slowing growth has historically been tricky for the Fed. Much of the time, the Fed prefers to delay significant policy decisions (rate hikes) until geopolitical risk diminish. The problem for the Fed currently is they are already behind the curve, and it may force a rate hike in March despite the conflict in Europe. I expect a rate increase next month.

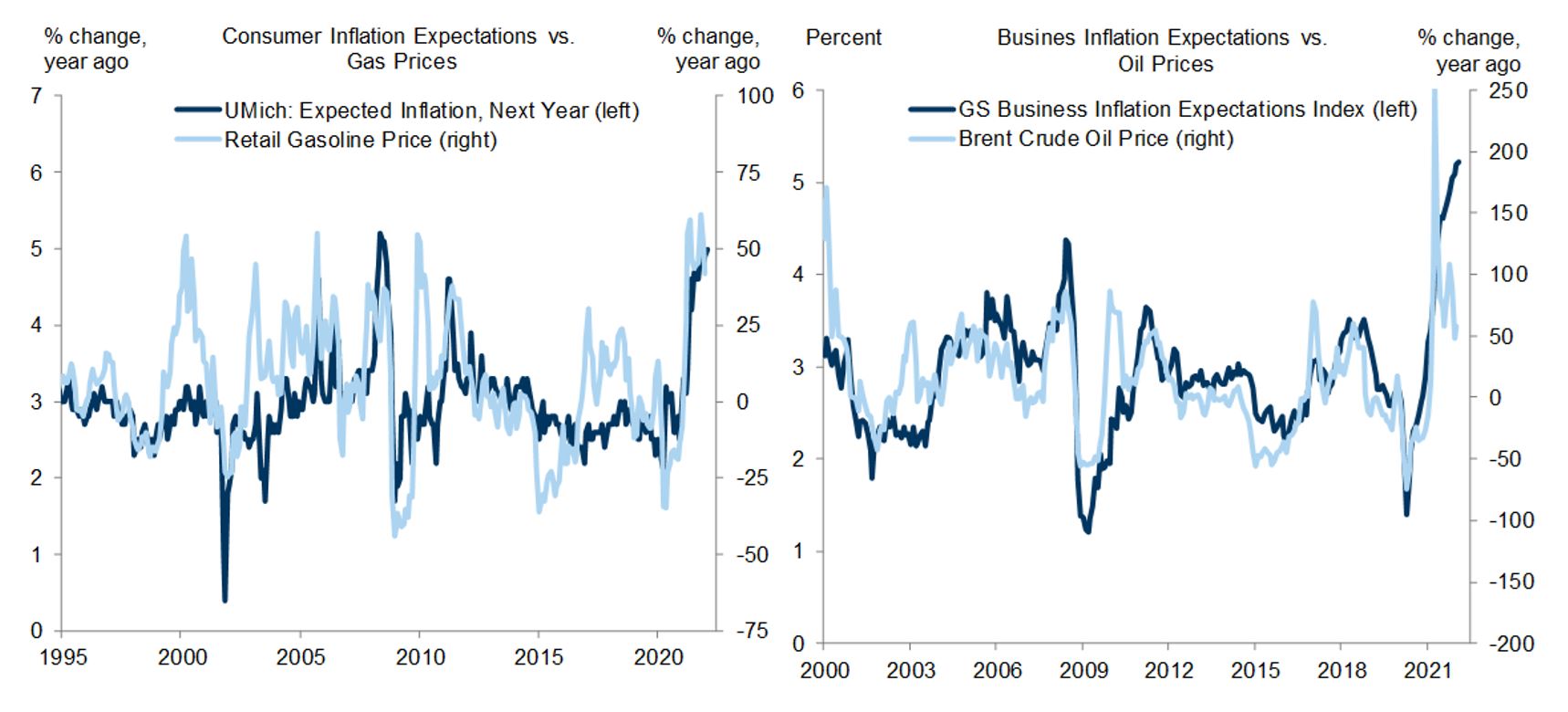

As you can see in the charts below, near-term inflation expectations were already high before the invasion and are very sensitive to energy prices (source: Goldman Sachs).

In Europe, things are no better. Energy prices will push inflation up significantly. The ECB will likely argue that the negative GDP impact will help keep inflation at bay. I believe this is wishful thinking. Europe is dependent on Russian energy, and they are likely going to see more significant increases in fuel prices, which will seep into the cost of goods.

So, what does this mean for the markets?

The S&P is well into “correction” territory, and we have broken a critical level of support which was 4275. In talking with several technical analyses this morning, all have said they think the next level of support is around 3840 level. This would put the index very close to “bear market” territory.

Companies adversely affected by oil (i.e., airlines) could sell off until oil prices stabilize. Conversely, energy (and infrastructure) could continue to rally as prices in WTI have now crossed over $100 a barrel.

In the future, I hope the current administration reassesses its position on energy so the U.S. is not dependent on any foreign oil and natural gas. Energy independence with a longer-term sustainable energy policy would help buffer the U.S. economy in the future from these types of energy spikes. For now, we are all going to have lighter wallets.

The silver lining could potentially be that the Fed doesn’t have to raise rates more than 3 or 4 times to get inflation under control. I estimated that volatility would wain and equities would start their move higher by Q4. If (and it’s a big “if”), the Fed does not have to raise rates 5 or 6 times, that may benefit equities by Q3.

Lastly, this is a great time to make a wish list on investments that you want to buy. Not to make light of the happenings in Ukraine, but in my head, I am singing, “It’s beginning to look a lot like Christmas,” because over the last year, I have resisted buying investments at overbought levels. This may be our chance to buy things at oversold levels, which is how we can make money.

Have patience and work with your Perigon advisor to create a plan. I would also ask that we pray or think about those innocent people in harm’s way.

Hang in there. It’s going to be OK.

Stephen Colavito, Jr.

Chief Investment Officer

Perigon Wealth Management, LLC

D,M: 404.313.1382

E: stephen@perigonwealth.com

This message is provided for informational purposes and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. Perigon Wealth Management is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling (415) 430-4140 or sending an email request to Compliance@PerigonWealth.com