Global Market Commentary at a Glance

Global stocks rose 2.24% MTD

Volatility (VIX) climbed to 17.44

Fed rates are now at 3.75–4.00% range

10-year Treasury yield eased to 4.08%

Japan’s Nikkei 225 reached 52,411

Gold cooled to $4,002.92/oz

Bitcoin and Ethereum falling 4.55% and 8.01%, respectively

Global stocks sidestepped the typical “October Surprise”

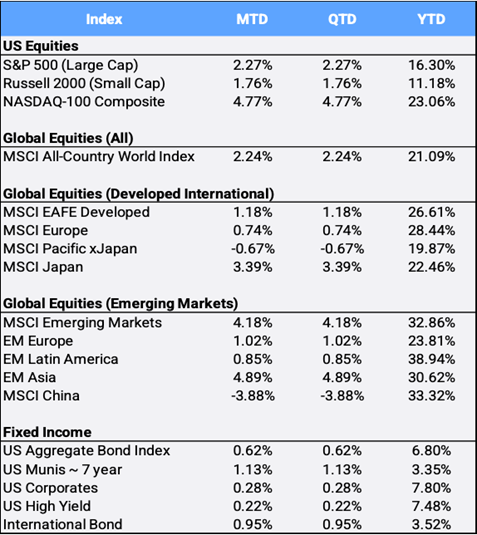

Global stocks gained 2.24% MTD to mark seven consecutive months of gains. The MSCI All Country World Index (ACWI) made 15 new all-time highs this month to bring its tally to 49 on the year and bringing its collective 2025 YTD return to 21.09%.

Since the post-tariff announcement low touched on April 8th, the global benchmark has rallied 36.57% from back when it was then down 11.34% YTD.

Markets responded positively to a truce between Washington and Beijing

The truce came following a high stakes meeting between President Donald Trump and his Chinese counterpart Xi Jinping held in South Korea that resulted in a de-escalation of trade tensions.

The two reached a trade deal over rare earth elements that had threatened to push the world’s two largest economies into a full-blown trade war.

October has seen some of the largest daily losses in stock market history

Even with US equity markets rallying, the CBOE S&P Volatility Index (VIX), often referred to as “the fear index”, closed October up 7.13% to 17.44.

Often, stock performance and volatility are negatively correlated, so it is peculiar to see them both up, but the increase in uncertainty may be due to:

- Official economic statistics on jobs

- Inflation

- Consumer spending being stalled during the US government shutdown whose funding expired on October 1st

Fed Chairman Jerome Powell dampened hopes for a December rate cut

As expected, the US Federal Reserve cut the Fed Fund rate by 25 bps when it met on October 29th to its lowest in three years with a target range of 3.75-4.00%. Fed Chairman Jerome Powell dampened hopes for another rate cut at a press conference afterward saying another one come December is far from a foregone conclusion.

Fed funds futures traders are pricing in a 63% probability of a cut in December, down from 93% before the Fed meeting. The central bank doesn’t meet in November.

The 10-year Treasury yield traded down from September

Used as a reference rate on everything from credit card debt, mortgages, and student loans, the 10-year Treasury yield traded as low as 3.95% during the month before closing October at 4.08%, down from 4.15% in September and from 4.57% where it started 2025.

As yields and prices move in opposite directions, a strong rally in the US Aggregate Bond market continued, gaining 0.62% MTD to bring YTD returns to 6.80%.

Asia leads the October rally

Policy shifts add fuel to Japan’s momentum

Japan’s famed Nikkei 225 index closed the month at a record high of 52,411, and led developed markets higher as MSCI EAFE’s largest country contributor to gains this month with Softbank, up 38.89% MTD as EAFE’s largest contributing stock.

Hardline conservative Sanae Takaichi became the country’s first female prime minister after winning the presidency of the ruling party. She is expected to pursue more fiscally expansive policies to boost economic growth.

Korea and Taiwan stand out in emerging markets

In emerging markets, returns were led by contributors South Korea and Taiwan, whose stock indexes gained 22.65% and 10.79% MTD, respectively.

Taiwan Semiconductor had the biggest influence on global stocks outside of the US, as its shares gained 13.93% in September. In Korea, tech stocks rallied after US chipmaker Nvidia announced it was collaborating with the South Korean government to expand the nation’s AI infrastructure.

The Nvidia “halo effect” also touched Korean car-maker Hyundai

Hyundai, up 32.56% MTD, and Nvidia announced it was deepening their partnership for autonomous vehicles, robotics, and smart factories, with a new AI factory powered by its latest Blackwell AI processors. Korea is also the leading country market YTD, up 89.84% so far in 2025.

The gold rush may also be cooling as the precious metal

Gold – which investors often flock to as a stable asset in times of volatility – made an all-time high of $4356.30/oz on October 20th, before experiencing its biggest drop in more than a decade and closing the month at $4,002.92/oz or 8.11% below its peak. Still, it posted its third straight month of gains, returning 3.73% MTD to bring YTD returns to 52.52%.

Central banks moving away from traditional safe-haven assets

Largest buyers of gold include central banks in China, India, Russia, and others that are starting to move away from traditional safe-haven assets like US Treasuries. Meanwhile, silver is supported by industrial demand, specifically in solar panels, batteries, and data centers.

As an investment, silver added 4.38% MTD to bring its return to 68.46% YTD.

Digital gold and silver are weighing down their gains

Sometimes investors refer to Bitcoin and Ethereum as “digital gold and silver” as they are the two largest cryptocurrencies.

However, these digital coins are lagging their analogous physical counterparts, falling 4.55% and 8.01% this month, respectively, weighing down their YTD gains that now stand at 16.77% and 15.34%, respectively.

Disclosure Statement

Perigon Wealth Management, LLC (“Perigon”) is an independent registered investment adviser. Form ADV Part 2 is available upon request by calling 415-430-4140 or emailing compliance@perigonwealth.com. For additional disclosures, visit perigonwealth.com.

Past performance is not indicative of future results. Investments may lose value, and nothing contained herein should be construed as legal, tax, or investment advice, or as an offer or solicitation to buy or sell any security. Information is for educational purposes only and obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Data Source: Bloomberg Pricing Data, as of October 31, 2025.