When will it stop? Everyone seems to have a theory. And yet none of us knows for sure. The news flow has most of us on edge. Everyone wants answers. And few of them are terribly comforting. Questions needing a concrete response are met with phrases like: “we think, we hope, we believe, or we have no way of knowing exactly…”

It reminds me a bit of the 2008 financial crisis.

Back then, we woke up every day to violent market swings and progressively more uncertain news flow – most of it bad. Ultimately, policy makers and central bankers around the world coalesced with solutions that, however imperfect, allowed the world to move on.

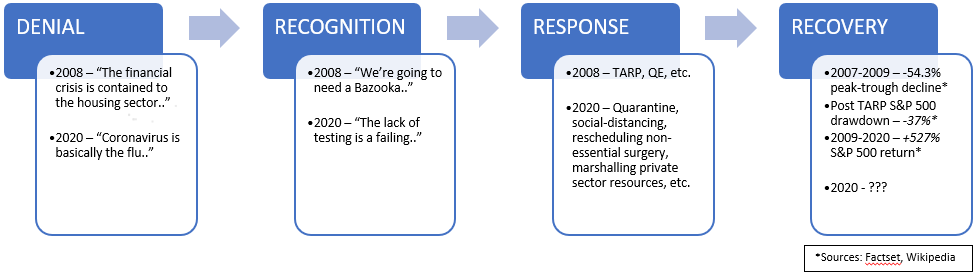

Today the similarities to the 2008 financial crisis, as I see them, look crudely like this:

For investors, the focal point seems to be the bullet on the bottom right, aka the market’s future performance. No one knows where the bottom is. And the speed of the volatility has created a sense of flat-footedness for most. Along the lines of: “…it’s probably too late to sell, but is it too early to buy??” Firms are tripping over themselves to publish strategy pieces telling investors what to do with their money.

Yet ultimately, the answer to “what should I do?” is unknowable.

And we have to live with it. It depends too much on our individual risk tolerance, time horizon for our growth assets, and future expense liabilities to be a one-size-fits-all answer.

It should be obvious that we are probably going into a sharp recession that started around March 1st. It could last until August or September, perhaps longer. Goldman Sachs is estimating -5% annualized GDP growth in the second quarter. And that could be optimistic.

Data tell us that investing after similar violent declines in price tend to yield substantial returns one year later, in most instances1, 2. Moreover, results are particularly strong when the market declines are centered around most disease-outbreaks, rather than a period precipitated by financial excesses, such as 1929, 2000, or 20083, 4.

In short, we have a weight of evidence suggesting now may be a good time to start buying.

However, just because the evidence says we probably should, it doesn’t mean that we definitely will earn positive returns on equities one year from now. Such is the nature of uncertainty.

Additionally, it is probably worth mentioning that the major caveat with this situation is there has never been a disease outbreak in living memory that’s required essentially global quarantine to stop its spread. All the medical professionals and data scientists are telling us it will be bad, particularly the worst-case scenarios5, 6. CDC is estimating that between 160-214 Million people could be infected7. Meanwhile, at this writing, Johns Hopkins estimates 14,631 Americas are currently infected8. No one knows how lasting the financial and economic impact will be. The next two quarters will be bad for the economy, almost without question, but we can’t know the long-term impact yet.

Everyone is hoping for a V or U-shaped recovery9, 10. Personally, I don’t disagree. The question seems to be, how soon will it happen? Once the number of cases slows and the virus appears otherwise containable, asset values will probably be low enough that they’re attractive enough to buy. And people will certainly want to get the heck out of their houses, stop working from home, and celebrate the end of this thing.

Additionally, the Fed, the President, and Congress appear committed to doing whatever it takes to contain the economic fallout11, 12, 13. California is the first state to issue “shelter-in-place” and “stay at home” orders to all citizens14, 15. In my view, other states and the Federal government will probably follw suit at some point16, 17, 18. And the sooner the better19. All these things should coalesce to our benefit sooner or later, even if their effects aren’t immediately felt.

In my view, they key thing for investors to do is determine precisely how much capital they’ll need to get through this downturn, then review their tolerance for risk, look at their future liabilities, and then develop a plan for how they’ll approach this opportunistically, all without getting over their skis.

This should be easy enough provided you’re working closely with the right advisor. That person won’t know where the bottom is, but they should be able to help you formulate a prudent strategy without making any critical mistakes. At this point, that is probably all one can ask for.

Sources:

- Sundial Capital Research, www.sentimentrader.com, Daily Report – March 16, 2020

- Jurien Timmer, Director of Global Macro – Fidelity Investments;

- First Trust

- Cliffwater

- Mark Landler and Stephen Castle, Behind the Virus Report That Jarred the US and the U.K. to Action; New York Times; March 17, 2020

- Sheri Fink, Worst Case Estimates for U.S. Coronavirus Deaths; New York Times; March 13, 2020

- Ibid

- Coronavirus COVID-19 Global Cases; Center for Systems Science and Engineering (CSSE) at Johns Hopkins University (JHU)

- Brian Wesbury, First Trust Investments; Fed Fires Bazooka at Coronavirus; March 16, 2020

- Callum Keown, Marketwatch; Goldman says U.S. Growth will shrink 5% next quarter and here’s how low stocks could go; March 17, 2020

- United States Federal Reserve; Press Releases

- United States Treasury Dept; Press Releases

- Phil Mattingly, Clare Foran, Ted Barrett; CNN; Senate Republicans unveil $1 trillion Economic Stimulus Package to Address Coronavirus Fallout; March 20, 2020

- Pater Arcuni, Polly Stryker; KQED; California Gov. Gavin Newsom Issues Statewide Shelter-in-Place Order; March 19, 2020

- New York State Coronavirus Updates – https://coronavirus.health.ny.gov/home

- Centers for Disease Control, The White House; 15 Days to Slow the Spread

- New York Times; Cuomo Orders Tighter Restrictions in New York: Live Updates

- Patrick Quinn, KOMO News; No Shelter-in-Place Order for Washington State – Yet; March 19, 2020

- Clayton Dalton; Opinion; The Guardian; I’m an ER Doctor. Please Take Coronavirus Seriously; Marc 20, 2020